stanislaus county tax collector property tax

Monday - Friday 830 am -500 pm Pay by phone 1-888-586-0302. 209 525-6388 Visit Website Map Directions 1010 10th St Ste 2500Modesto CA 95354 Write a Review.

Property Tax California H R Block

Please mail early to avoid penalties.

. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Proposition 13 enacted in 1978 forms the basis for the current property tax laws. The median property tax on a 28520000 house is 211048 in California.

See reviews photos directions phone numbers and more for County Stanislaus Treasurer Tax Collector Property Tax Bill locations in Modesto CA. The median property tax on a 28520000 house is 188232 in Stanislaus County. Stanislaus County collects relatively high property taxes and is ranked in the top half of all counties in the United States by.

Ford Stanislaus County Tax Collector PO Box 859 Modesto CA 95353. Treasurer Tax Collector View Item 4. 1010 10th Street Suite 2500.

Our website is an ongoing part of my commitment to keeping you informed of your rights and responsibilities as property owners in Stanislaus County. You can call the Stanislaus County Tax Assessors Office for assistance at 209-525-6461. Approval of the 2022-2023 Megabyte Property Tax System Maintenance Agreement with Megabyte Systems Inc.

The median property tax also known as real estate tax in Stanislaus County is 187400 per year based on a median home value of 28520000 and a median effective property tax rate of 066 of property value. Get driving directions to this office. If you have documents to send you can fax them to.

See detailed property tax information from the sample report for 4217 Dynasty Ln Stanislaus County CA. Assessor View Item 9. Stanislaus County Tax Collector.

The canceled checkmoney order stub serves as your receipt. Stanislaus County collects on average 066 of a propertys assessed fair market value as property tax. Make checkmoney order payable to SF Tax Collector.

209 525 6461 Phone 209 525 6586Fax The Stanislaus County Tax Assessors Office is located in Modesto California. Ad Find Stanislaus County Online Property Taxes Info From 2021. Stanislaus 2022 Property Statement E-Filing 32022500008.

The Tax Collector only accepts the US Postal Service postmark. If you do not have the stub s list the parcel number s andor address es on a piece of paper and send it with your payment to. Stanislaus County Assessors Office Services.

When contacting Stanislaus County about your property taxes make sure that you are contacting the correct office. It is the responsibility of the Auditor-Controllers Property Tax Division to allocate and distribute the. To contact our office directly please call 209 525-6461 800 AM to 430 PM.

See reviews photos directions phone numbers and more for County Stanislaus Treasurer Tax Collector Property Tax Bill locations in Livingston CA. Stanislaus County has one of the highest median property taxes in the United States and is ranked 525th of the 3143 counties in order of median property taxes. You must review all of this information for accuracy and make necessary corrections for your current year E-Filing.

Approval to Set a Public Hearing on June 28 2022 at the 900 AM. As the elected Assessor of Stanislaus County it is my sworn responsibility to uphold the States Property Tax Laws. Approval to Amend the Agricultural Advisory Board Bylaws.

Do not send cash. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Stanislaus County Tax Appraisers office. Closed Saturdays Sundays Holidays.

The Stanislaus County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Stanislaus County and may. Stanislaus County CA Page 1. 1010 10th Street Ste.

Office of the Treasurer Tax Collector. If you E-Filed last year you will be shown what you E-Filed or what the Assessor has on file. Stanly County Courthouse 201 South Second Street Albemarle NC 28001 Hours of Operation.

The median property tax in Stanislaus County California is 1874 per year for a home worth the median value of 285200. The tax rate is equal to one percent 1 plus bonded debt for the location of the assessed property. Receive Stanislaus County Property Records by Just Entering an Address.

Include Block and Lot number on memo line. The County Auditor-Controllers Property Taxes Assessments Division computes the amount of tax due by multiplying the taxable value of the property by the applicable tax rate. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

10 Acres Starting At Just 59 900 Farm Gate Acre Ranches For Sale

How To Calculate Property Tax And How To Estimate Property Taxes

Contacts Treasurer Tax Collector Stanislaus County

The Property Tax Inheritance Exclusion

How Much Is Property Tax In California Caris Property Management

Stanislaus County To Conduct First Ever Online Tax Sale On Bid4assets

Playa Marina Apts 12427 W Jefferson Los Angeles Ca 90066 Rent Com Playa Los Angeles Apartments Apartments For Rent

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Contacts Treasurer Tax Collector Stanislaus County

California Public Records Public Records California Records

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Property Taxes Why Some Local Governments Get More Than Others

1997 98 Budget Analysis Property Taxes Why Some Local Governments Get More Than Others

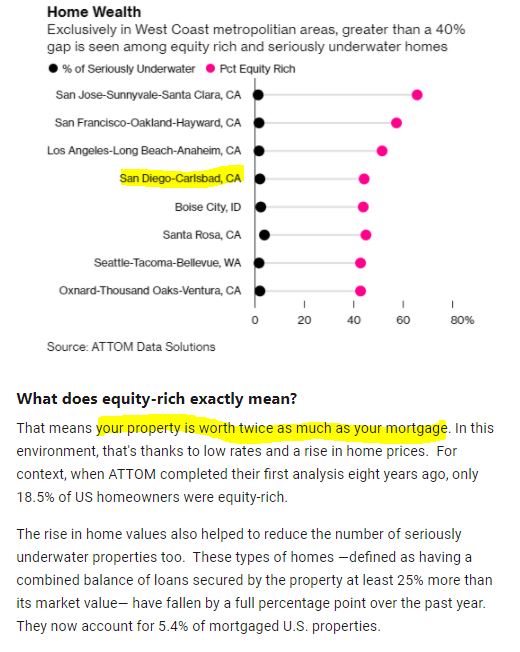

Property Tax Re Assessment Bubbleinfo Com

10 Acres Starting At Just 59 900 Farm Gate Acre Ranches For Sale

Take Advantage Of The Amazing Rewards Of Owning 0 23 Acres Of Land L Kern County Ca California City Acre Kern County